Introduction

Stock Market Terminology – Today everyone wants to make money from Stock Market or Stock Exchange. Everybody wants to become a millionaire in this Sector, but not everyone is getting it. There can be many reasons for not succeeding and one of them is not understanding Stock Market Terminology very well. Unless you understand the Stock Market Terminology very well, there will be a strong chance of your failure. Just like when you’re willing to learn a new language, at the very first you command vocabulary so you can understand and learn the language. Today we will talk about Top 10 Stock Market Terminology.

List of Stock Market Terminology

- P/E Ratio

- Bull Market

- Bear Market

- SIP

- Bonds

- EPS

- IPO

- FPO

- EBITDA

- Blue Chip Stocks

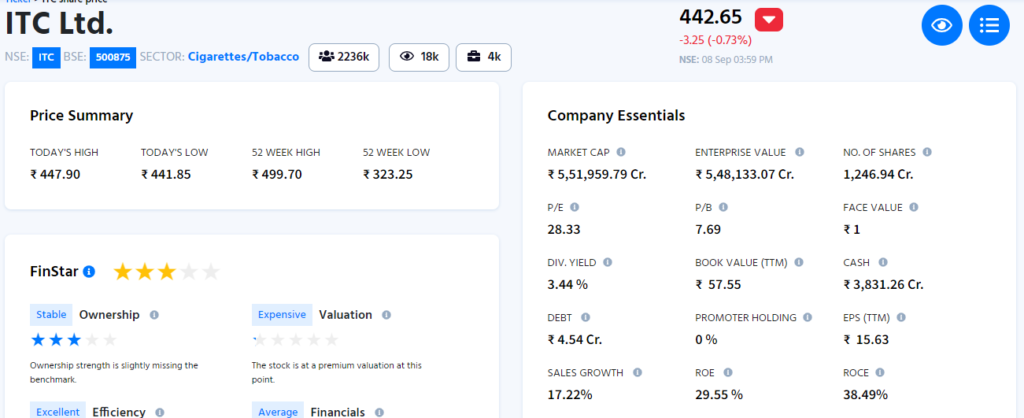

P/E Ratio

Formula = Current Market Price of a Share / Earnings per Share

P/E Ratio refers Price to Earnings Ratio. Analysts and Investors use it a lot. P/E tells how much money you have to invest to earn 1 rupee from that company. Like ITC Company’s P/E is 28.33 which means you have to invest 28 Rupees & 33 Paise to earn 1 rupee from it.

When the P/E of a company is high then that company is considered overvalued. There can be many reasons for high P/E – the company is continuously growing or the company has recently taken some decision which indicates that the company is going to grow very fast in the near future, the P/E also increases.

On the other hand, if the P/E is low, it means the company is undervalued. There can be many reasons for this, such as the possibility of poor performance of the company in the future or govt brought some policies that don’t support the company’s business & functionality, due to which the stock prices of the company are falling today.

Bull Market

Bull Market or Bullish Market is a trend that has continued in the market for some time. In this trend, the stock price moves upwards. When the Stocks are growing at 20% in the market, it is called a Bull Market. To take advantage of this, you have to observe the market very well, then you will be able to understand why the market is in Bull Run and how long it is likely to remain in it.

Bear Market

Bear Market or Bearish Market is also a trend. In this trend, the market goes down. In this trend, the stock price moves down. When the Stocks are declining at 20% in the market, it is called a Bear Market.

There can be many reasons for this, such as the stock price of a company increasing unexpectedly, bubble formation in the market, lack of confidence in the economy or the leadership of the country etc. If you want to make money at this time, you have to wait till the market goes to its actual value point. Pick the stocks you want and sell them when the market recovers.

Mutual Fund

Mutual Funds is a very important Stock Market Terminology list. There are many options for investment in the Stock Market i.e. Stocks, Mutual Funds, Commodity, Forex, etc. Mutual Fund is one of the best options for making money with low risk. Investing in stocks is very risky and the market price of some companies is so high that everybody can’t afford to invest in them. Mutual Fund comes for this problem.

A Mutual Fund is made by combining many companies. There are some Fund managers who do the work for us. Mutual Fund name defines its investment sector i.e. if there is a term “Mid Cap” in the name, it means its investment will be in Mid Cap Companies.

Mutual Funds invest in many sectors including govt projects, equities, bonds, etc.

Systematic Investment Plan – SIP

Stock Market Terminology SIP is an investment option that gives you the flexibility to invest on a monthly basis. You will get this option in Mutual Funds. Interestingly you don’t get shares or stocks on your invested money, You get units in this option because it works in a Mutual Fund and a mutual fund provides the unit of invested money.

Bonds

Bonds are high-security debt instruments. Any Entity, whether it is a Private Company or a government organization, needs money for operations and development. When these entities want money from the public rather than any banks or lending bodies they offer bonds in return for the money. Bonds have all the details about the invested money i.e. How long the money will be invested, How much amount investor will get in the tenure, what will be the interest rate and many other information like this.

EPS

Stock Market Terminology EPS stands for “Earnings Per Share”. As the name suggests, it tells you how much earnings you will have or are getting on your shares. The formula to calculate it is:-

EPS = (Net Income − Preferred Dividends)/End-of-Period Common Shares Outstanding

Using this formula you can calculate the EPS of any company and then decide whether you want to invest in that company or not.

IPO

Another Stock Market Terminology IPO means Initial Public Offering. IPO comes when any company wants money from the public first time and in exchange it wants to provide shares for its investors. In this process company shares the details to SEBI like what is company’s working area, who are the management, why the company wants money, and many more information including balance sheets. When a company files a document to SEBI it is called DRAFT RED HERRING PROSPECTUS (DRHP). When SEBI approves it is called RED HERRING PROSPECTUS (RHP). SEBI provides the date to launch the IPO if SEBI finds all the documents and reasons are valid and ethical.

FPO

FPO Stands for “Follow on Public Offer”. This Stock Market Terminology is used when the listed company again wants money from the public. It brings FPO. If a company has performed well from IPO till FPO, then there is a possibility of the FPO being subscribed better but if any negative news comes in the market then it impacts the FPO. Its best example is the Hindenburg Report which was released in January 2023 for Adani Enterprise which was not in favor of Adani Group, it had a negative impact on the company’s reputation and wealth, and due to this Adani Group had to withdraw FPO.

EBITDA

EBITDA stands for “Earnings Before Interest, Tax, Depreciation & Amortization”. When a company generates revenue it is called EBITDA because it doesn’t include any kind of deduction in it. After including all these deductions it is called the “Net Income” of that company. Many investors do not like this Stock Market Terminology because it can be manipulated using loans and many companies do.

Blue Chip Stocks

There are some companies that contribute a lot to the economy. Failure of such companies means failure of the economy, hence such companies are called Blue Chip Companies. Return on the money invested in these companies may be less compared to other companies, but your money is considered safe. Some blue-chip companies are Reliance, Wipro, HCL, etc.

Conclusion

This Stock Market Terminology is very important when you are willing to invest money in the stock market. We have discussed a few terms from the list. There are many more to share.